Global Market Comments

January 22, 2021

Fiat Lux

Featured Trade:

(JANUARY 20 BIWEEKLY STRATEGY WEBINAR Q&A),

(QQQ), (IWM), (SPY), (ROM), (BRK/A), (AMZN), NVDA), (MU), (AMD), (UNG), (USO), (SLV), (GLD), ($SOX), CHIX), (BIDU), (BABA), (NFLX), (CHIX), ($INDU), (SPY), (TLT)

Tag Archive for: (IWM)

Below please find subscribers’ Q&A for the January 20 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Incline Village, NV.

Q: What will a significant rise in long term bond yields (TLT) do to PE ratios in general, and high tech specifically?

A: Well, the key question here is: what is “significant”. Is “significant” a move in a 10-year from 120 to 150, which may be only months off? I don’t think that will have any impact whatsoever on the stock market. I think to really give us a good scare on interest rates, you need to get the 10-year up to 3.0%, and that might be two years off. We’re also going to be testing some new ground here: how high can bond interest rates go while the Fed keeps overnight rates at 25 basis points? They can go up more, but not enough to hurt the stock market. So, I think we essentially have a free run on stocks for two more years.

Q: What about the Shiller price earnings ratio?

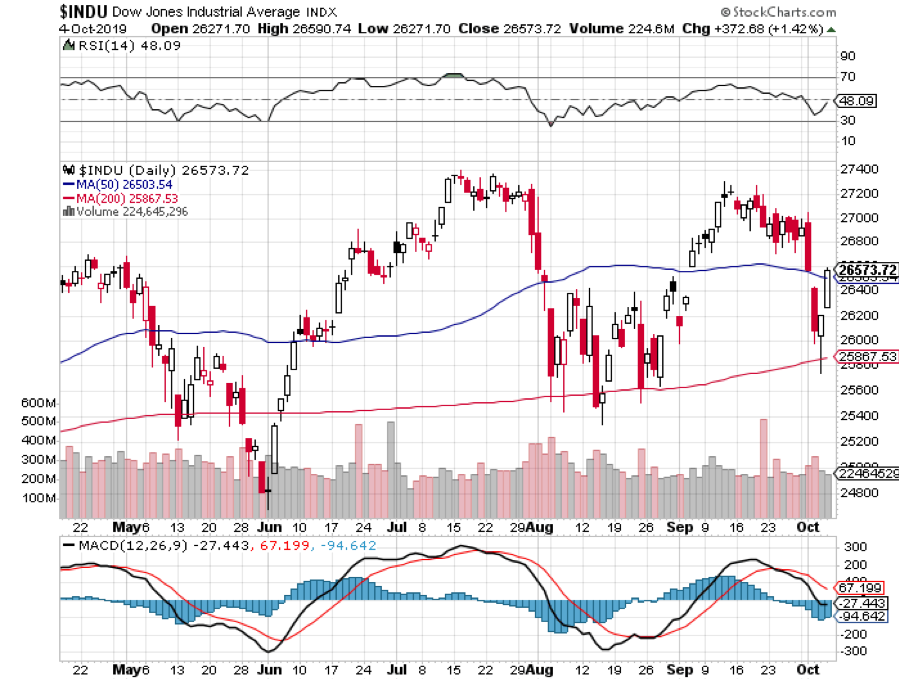

A: Currently, it’s 34.5X and you want to completely ignore anything from Shiller on stock prices. He’s been bearish on stocks for 6 years now and ignoring him is the best thing you can do for your portfolio. If you had listed to him, you would have missed the last 15,000 Dow ($INDU) points. Someday, he’ll be right, but it may be when the market goes from 50,000 to 40,000, so again, I haven't found the Shiller price earnings ratio to be useful. It’s one of those academic things that looks great on paper but is terrible in practice.

Q: Do you see any opportunity in China financials with the change of administration, like the (CHIX)?

A: I always avoid financials in China because everyone knows they have massive, defaulted loans on their books that the government refuses to force them to recognize like we do here. So, it’s one of those things where they look good on paper, but you dig deeper and find out why they’re really so cheap. Better to go with the big online companies like Baidu (BIDU) and Alibaba (BABA).

Q: Is it too late to enter copper?

A: No, the high in the last cycle for Freeport McMoRan (FCX) was $50 dollars and I think we’re only in the mid $ ’20s now, so you could get another double. Remember, these commodity stocks have discounted recovery that hasn’t even started yet. Once you do get an actual recovery, you could get another enormous move and that's what could take the Dow to 120,000.

Q: Do you see the FANGs coming back to life with the earnings results?

A: I think it'll take more than just Netflix to do that. By the way, Netflix (NFLX) is starting to look like the Tesla of the media industry, so I’d get into Netflix on the next dip. You could get a surprise, out-of-nowhere double out of that anytime. But yes, FANGs will come to life. They've been in a correction for five months now, and we’ll see—it may be the end of the pandemic that causes these stocks to really take off. So that's why I'm running the barbell portfolio and buying the FANGs on weakness.

Q: Are you recommending LEAPS on gold (GLD) and silver (SLV)?

A: Absolutely yes, go out two years with your maturity, you might buy 120% out of the money. That's where you get your leverage on the LEAPS. Something like a (GLD) January 2023 $210-$220 in-the-money vertical bull call spread and generate a 500% profit by expiration.

Q: Do you foresee a cool off for semiconductors ($SOX) even though there's been recent news of shortages?

A: No, not really. There are so many people trying to get into these it’s incredible. And again, we may get a time correction where we sideline at the top and then break out again to the upside. This is classic in liquidity-driven markets, which is what we have in spades right now. Thanks to 5G, the number of chips in your everyday devices is about to increase tenfold, and it takes at least two years to build a new chip factory. So, keep buying (NVDA), (MU), and (AMD) on dips.

Q: Where are the best LEAPS prospects (Long Term Equity Participation Securities)?

A: That would have to be in technology—that's where the earnings growth is. If you go 20% out of the money on just about any big tech LEAPs two years out, to 2023 those will be worth 500% more at expiration.

Q: What about SPACs (Special Purpose Acquisition Company) now, as we’re getting up to five new SPACs a day?

A: My belief is that a SPAC is a vehicle that allows a manager to take out a 20% a year management fee instead of only 1%. And it's another aspect of the current mania we’re in that a lot of these SPACs are doubling on the first day—especially the electric vehicle-related SPACs. Also, a lot of these SPACs will never invest in anything, but just take the money and give it back to you in two years with no return when they can't find any good investments…. If you’re lucky. There's not a lot of bargains to be found out there by anyone, including SPAC managers.

Q: Does natural gas (UNG) fall into the same “avoid energy” narrative as oil?

A: Absolutely, yes. The only benefit of natural gas is it produces 50% less carbon dioxide than oil. However, you can't get gas without also getting oil (USO), as the two come out of the pipe at the same time; so I would avoid natural gas also. Gas and oil are also about to lose a large chunk, if not all, of their tax incentives, like the oil depletion allowance, which has basically allowed the entire oil industry to operate tax-free since the 1930s.

Q: What about hydrogen cars?

A: I don't really believe in the technology myself, and when you burn hydrogen, that also produces CO2. The problem with hydrogen is that it’s not a scalable technology. It’s like gasoline—you have to build stations all over the US to fuel the cars. Of course, it produces far less carbon than gas or natural gas, but it is hard to compete against electric power, which is scalable and there's already a massive electric grid in place.

Q: If you inherited $4 million today, would you cost average into (QQQ), (IWM), or (SPY)?

A: I would go into the ProShares Ultra Technology ETF (ROM), which is double the (QQQ); and if you really want to be conservative, put half your money into (QQQ) or (ROM), and then half into Berkshire Hathaway (BRK/A), which is basically a call option on the industrial and recovery economy. I know plenty of smart people who are doing exactly that.

Q: Is it weird to see oil, as well as green energy stocks, moving up?

A: No, that's actually how it works. The higher oil and gas prices go, the more economical it is to switch over to green energy. So, they always move in sync with each other.

Q: I heard rumors that Amazon (AMZN) is likely to raise Prime’s annual fee by $10-20 a year in 2021. Will that be a catalyst for the stock to go higher?

A: Yes. For every $10 dollars per person in Prime revenue, Amazon makes $2 billion more in net profit. I would say that's a very strong argument for the stock going up and maybe what breaks it out of its current 6-month range. By the way, Amazon is wildly undervalued, and my long-term target is $5,000.

Q: Do you think that the spike in Apple (AAPL) MacBook purchases means that computers will overtake iPhones as the revenue driver for Apple in 2021, or is the phone business too big?

A: The phone business is too big, and 5G will cause iPhone sales to grow exponentially. Remember, the iPhones themselves are getting better. I just bought the 12G Pro, and the performance over the old phone is incredible. So yeah, iPhones get bigger and better, while laptops only grow to the extent that people need an actual laptop to work on in a fixed office. Is that a supercomputer in your pocket, or are you just glad to see me?

Q: Share buybacks dried up because of revenue headwinds; do you think they will come back in a massive wave, giving more life to equities?

A: Absolutely, yes. Banks, which have been banned from buybacks for the past year, are about to go back into the share buyback business. Netflix has also announced that they will go buy their shares for the first time in 10 years, and of course, Apple is still plodding away with about $100 or $200 million a year in share buybacks, so all of that accelerates. The only ones you won't see doing buybacks are airlines and Boeing (BA) because they have such a mountain of debt to crawl out from before they can get back into aggressive buybacks.

Q: Interest rates are at historic lows; the smartest thing we can do is act big.

A: That’s absolutely right; you want to go big now when we’re all suffering so we can go small later and run a balanced budget or even pay down national debt if the economy grows strong enough. The last person to do that was Bill Clinton, who paid down national debt in small quantities in ‘98 and ‘99.

Q: What do you think about General Motors (GM)?

A: They really seem to be making a big effort to get into electric cars. They said they're going to bring out 25 new electric car models by 2025, and the problem is that GM is your classic “hour late, dollar short” company; always behind the curve because they have this immense bureaucracy which operates as if it is stuck in a barrel of molasses. I don’t see them ever competing against Tesla (TSLA) because the whole business model there seems like it’s stuck in molasses, whereas Tesla is moving forward with new technology at warp speed. I think when Tesla brings out the solid-state battery, which could be in two years, they essentially wipe out the entire global car industry, and everybody will have to either make Tesla cars under license from Tesla—which they said they are happy to do—or go out of business. Having said that, you could get another double in (GM) before everyone figures out what the game is.

Q: Will you update the long-term portfolio?

A: Yes, I promise to update it next week, as long as you promise me that there won’t be another insurrection next week. It’s strictly a time issue. After last year being the most exhausting year in history, this year is proving to be even more exhausting!

Q: Do you see a February pullback?

A: Either a small pullback or a time correction sideways.

Q: Do you think the Zoom (ZM) selloff will continue, or is it done now that the pandemic is hopefully ending?

A: It’s natural for a tech stock to give up one third after a 10X move. It might sell off a little bit more, but like it or not, Zoom is here to stay; it’s now a permanent part of our lives. They’re trying to grow their business as fast as they can, they’re hiring like crazy, so they’re going to be a big factor in our lives. The stock will eventually reflect that.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

October 18, 2019

Fiat Lux

Featured Trade:

(OCTOBER 16 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPX), (C), (GM), (IWM), ($RUT), (FB),

(INTC), (AA), (BBY), (M), (RTN), (FCX), GLD)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader October 16 Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: How do you think the S&P 500 (SPX) will behave with the China trade negotiations going on?

A: Nobody really knows; no one has any advantage here and logic or rationality doesn’t seem to apply anymore. It suffices to say it will continue to be up and down, depending on the trade headline of the day. It’s what I call a “close your eyes and trade” market. If it’s down, buy it; if it’s, upsell it.

Q: How long can Trump keep kicking the can down the road?

A: Indefinitely, unless he wants to fold completely. It looks like he was bested in the latest round of negotiations because the Chinese agreed to buy $50 billion worth of food they were going to buy anyway in exchange for a tariff freeze. Of course, you really don’t get a trade deal unless you get a tariff roll back to where they were two years ago.

Q: Did I miss the update on the Citigroup (C) trade?

A: Yes, we came out of Citigroup a week ago for a small profit or a break-even. You should always check our website where we post our trading position sheet every day as a backstop to any trade alerts you’re getting by email. Occasionally emails just go completely missing, swallowed up by the ether. To find it go to www.madhedgefundtrader.com , log in, go to My Account, Global Trading Dispatch, then Current Positions. You can also find my newly updated long-term portfolio here.

Q: How much pain will General Motors (GM) incur from this standoff, and will they ever reach a compromise?

A: Yes, the union somewhat blew it in striking GM when they had incredibly high inventories which the company is desperate to get rid of ahead of a recession. If you wonder where all those great car deals are coming from, that's the reason. All of the car companies want to go into a recession with as little inventory as possible. It's not just GM, it’s everybody with the same problem.

Q: When does the New Daily Position Sheet get posted?

A: About every hour after the close each day. We need time to process our trades, update all the position sheets before getting it posted.

Q: What do you think about Bitcoin?

A: We hate it and don’t want to touch it. It’s unanalyzable, and only the insiders are making money.

Q: Are you predicting a repeat of Fall 2018 going into the end of this year to close at the lows?

A: No, I’m not. A year ago, we were looking at four interest rate increases to come. This year we’re looking at 1 or 2 more interest rate cuts. It’s nowhere near the situation we saw a year ago. The most we’re going to get is a 7% selloff rather than a 20% selloff and if anything, stocks will rise into the yearend then fall.

Q: Why are we trading the Russell 200 (IWM) instead of the ($RUT) Small Cap Index? We pay less commissions to brokers.

A: There's more liquidity in the (IWM). You have to remember that the combined buying power of the trade alert service is about $1 billion. And that’s harder to do with smaller illiquid ETFs like the ($RUT), especially the options.

Q: If this is a “Don’t fight the Fed” rally for investors, where else is there to go but stocks?

A: Nowhere. But it’s happening in the face of an oncoming recession, so it’s not exactly a great investment opportunity, just a trading one. 2009 was a great time not to fight the Fed.

Q: Do you want to buy Facebook (FB) even though there are so many threats of government scrutiny and antitrust breakups?

A: The anti-trust breakups are never going to happen; the government can't even define what Facebook does. There may be more requirements on disclosures, which means nothing because nobody really cares about disclosures—they just click the box and agree to anything. I was actually looking at this as a buy when we had the big selloff at the end of September and instead, I bought four other Tech stocks and (FB) had moved too far when we got around to it. I think there’s upside potential for Facebook, especially if we can move out of this current range.

Q: Would you sell short European banks? It seems like they’re cutting jobs right and left.

A: I always get this question after big market meltdowns. European banks have been underpricing risks for decades and now the chickens are coming home to roost. Some of these things are down 80-90% so it’s too late to sell short. The next financial crisis is going to be in Europe, not here.

Q: Is it time to short Best Buy (BBY) due to the China deal?

A: No, like Macys (M), Best Buy is heavily dependent on imports from China, and the stock has gotten so low it’s hard to short. And the problem for the whole market in general is all the best sectors to short are already destroyed, down 80-90%. There really is nothing left to short, now that all the bad sectors have been going down for nearly two years. There has been a massive bear market in large chunks of the market which no one has really noticed. So, that might be another reason the market is going up—that we’ve run out of things to short.

Q: Do you like Intel (INTC)?

A: Yes, for the long term. Short term it still could face some headwinds from the China negotiations, where they have a huge business.

Q: Would you buy American Airlines (AA) on the return of Boeing 737 MAX to the fleet?

A: Absolutely, yes. The big American buyers of those planes are really suffering from a shortage of planes. A return of the 737 MAX to the assembly line is great news for the entire industry.

Q: Do you like Raytheon (RTN)?

A: No, Trump has been the defense industry’s best friend. If he exits in the picture, defense will get slaughtered—it will be the first on the chopping block under a future democratic administration. And, if you’re doing nothing but retreating from your allies, you don't need weapons anyway.

Q: Will Freeport McMoRan (FCX) benefit from a trade war resolution?

A: Yes, the fact that it isn't moving now is an indication that a trade war resolution has not been reached. (FCX) has huge exposure to traditional metal bashing industries like they still have in China.

Q: Would you go long or short gold (GLD) here?

A: No, I'm waiting for a bigger dip. If you can get in close to the 200-day moving average at $129.50, that would be the sweet spot. Longer term I still like gold and it is a great recession hedge.

Good Luck and Good Trading!

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Yes, I Still Like Gold

Global Market Comments

October 14, 2019

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or UNICORNS AND CANDY CANE)

(AAPL), (FDX), (SPY), (IWM), (USO), (WMT), (AAPL), (GOOGL),

(X), (JPM), (WFC), (C), (BAC)

I have to tell you that flip-flopping from extreme optimism to extreme pessimism and back is a trader’s dream come true. Volatility is our bread and butter.

Long term followers know that when volatility is low, I struggle to make 1% or 2% a month. When it is high, I make 10% to 20%, as I have for two of the last three months.

That is what the month of October has delivered so far.

To see how well this works, the S&P 500 is dead unchanged so far this month, while the Mad Hedge Fund Trader alert service is up a gangbuster 10% and we are now 70% in cash.

While the market is unchanged in two years, risk has been continuously rising. That's because year on year earnings growth has fallen from 26% to zero. That means with an unchanged index, stocks are 26% more expensive.

Entire chunks of the market have been in a bear market since 2017, including industrials, autos, energy, and retailers. US Steel (X), which the president’s tariffs were supposed to rescue, has crashed 80% since the beginning of 2018.

The great irony here is that while the Dow Average is just short of an all-time high, all of the good short positions have already been exhausted. In short, there is nothing to do.

So, the wise thing to do here is to use the 1,200-point rally since Thursday to raise cash you can put to work during the next round of disappointment, which always comes. If we do forge to new highs, they will be incremental ones at best. That’s when you let your passive indexing friends pick up the next bar tab, who unintentionally caught the move.

In the meantime, we will be bracing ourselves for the big bank earnings due out this week which are supposed to be dismal at best. JP Morgan (JPM), Wells Fargo (WFC), and Citigroup (C) are out on Tuesday and Bank of America (BAC) publishes on Wednesday.

That’s when we find out how much of this move has been about unicorns and candy canes, and how much is real.

Trump demoed his Own trade talks, creating a technology blacklist and banning US pension investment into the Middle Kingdom. He also hints he’ll take a small deal rather than a big one. Great for American farmers but leaves intellectual property and forced joint ventures on the table, throwing the California economy under the bus. I knew it would end this way. It’s very market negative. Without a trade deal, there is no way to avoid a US recession in 2020.

The Inverted Yield Curve is flashing “recession.” The three-month Treasury yield has been above the 10-year bond yield since May, and that always says a downturn is coming. The time to batten down the hatches is now.

US Producer Prices plunged in September, down 0.3%, the worst since January. It’s another recession indicator but also pushes the Fed to lower rates further.

Inflation was Zero in September, with the Consumer Price Index up 1.8% YOY. Slowing economy due to the trade war gets the blame, but I think that accelerating technology gets the bigger blame.

New Job Openings hit an 18-month low, down 123,000 to 7.05 million in August, as employers pull back in anticipation of the coming recession. Trade war gets the blame. The smart people don’t hire ahead of a recession.

FedEx (FDX) is dead money, says a Bernstein analyst, citing failing domestic and international sales. No pulling any punches, he said “The bull thesis has been shredded.” Not what you want to hear from this classic recession leading indicator. Nobody ships anything during a slowdown.

Loss of SALT Deductions cost you $1 trillion, or about 4% per home, according to an analysis by Standard & Poor’s. Quite simply, losing the ability to deduct state and local tax deductions creates a higher after-tax cost of carry that reduces your asset value. If you bought a home in 2017 you lost half of your equity almost immediately. The east and west coast were especially hard hit.

Fed to expand balance sheet to deal with the short-term repo funding crisis, which periodically has been driving overnight interest rates up to an incredible 5%. Massive government borrowing is starting to break the existing financial system. What they’re really doing is trying to head off to the next recession.

The Fed September minutes came out, and traders seem to be expecting more rate cuts than the Fed is. Trade is still the overriding concern. The next meeting is October 29-30. It could all end in tears.

Apple (AAPL) raised iPhone 11 Production by 10%, to 8 million more units, according Asian parts suppliers. Great news for its $1,089 top priced product ahead of the Christmas rush. It turns out that an Apple app is helping Hong Kong protesters manage demonstrations. I’m keeping my long, letting the shares run to a new all-time high. Buy (AAPL) on the dips.

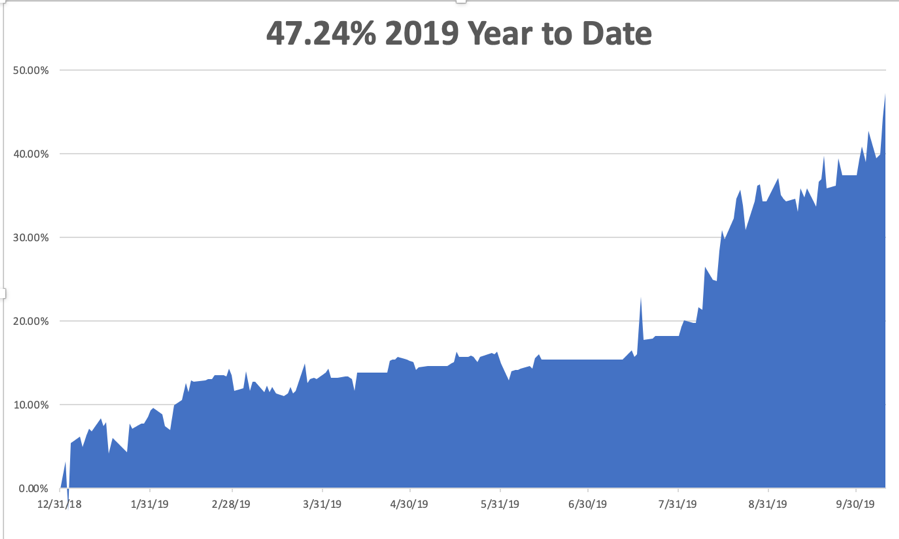

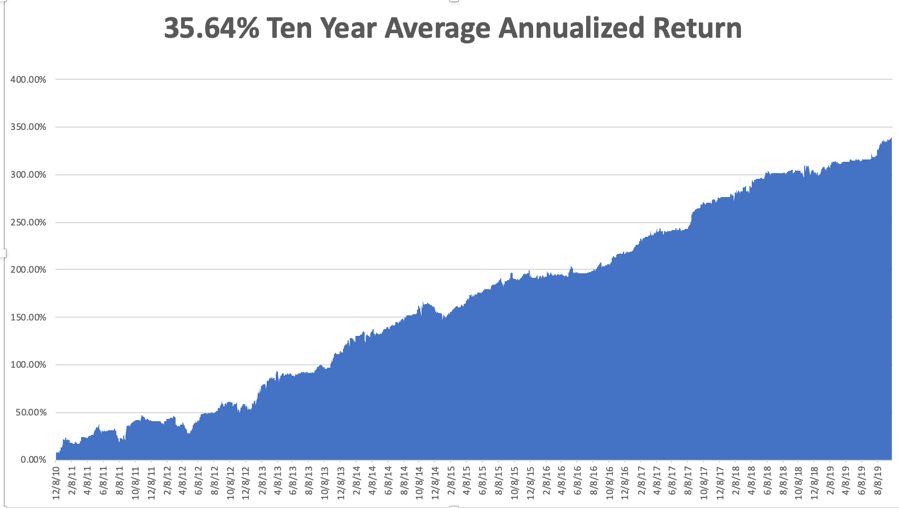

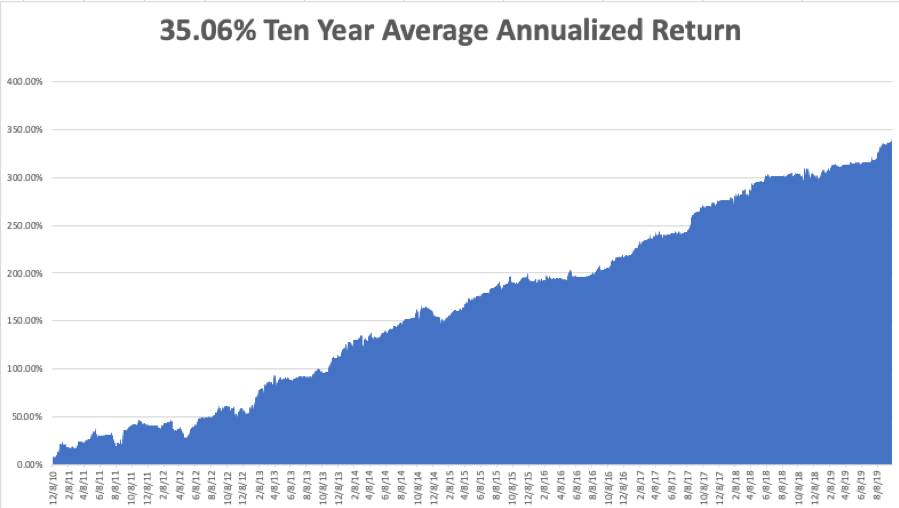

The Mad Hedge Trader Alert Service has blasted through to yet another new all-time high. My Global Trading Dispatch reached new apex of +347.48% and my year-to-date accelerated to +47.24%. The tricky and volatile month of October started out with a roar +9.82%. My ten-year average annualized profit bobbed up to +35.64%.

Some 26 out of the last 27 trade alerts have made money, a success rate of 94%! Underpromise and overdeliver, that's the business I have been in all my life. It works. This is rapidly turning into the best year of the decade for me. It is all the result of me writing three newsletters a day.

I used the recession fear-induced selloff after October 1 to pile on a large aggressive short-dated portfolio which I will run into expiration. I am 60% long with the (SPY), (IWM), (USO), (WMT), (AAPL), and (GOOGL). I am 10% short with one position in the (IWM) giving me a net risk position of 50% long. All of them are working.

The coming week is pretty non-eventful of the data front. Maybe the stock market will be non-eventful as well.

On Monday, October 14, nothing of note is published.

On Tuesday, October 15 at 8:30 AM, the New York Empire State Manufacturing Index is released. JP Morgan (JPM), Wells Fargo (WFC), and Citigroup (C) kick off the Q3 earnings season with reports.

On Wednesday, October 16, at 8:30 AM, we learn the September Retail Sales. Bank of America (BAC) and CSX Corp. (CSX) report.

On Thursday, October 17 at 8:30 AM, the Housing Starts for September are out. Morgan Stanley (MS) reports.

On Friday, October 18 at 8:30 AM, the Baker Hughes Rig Count is released at 2:00 PM. Schlumberger (SLB), American Express (AXP), and Coca-Cola (KO) report.

As for me, I’ll be going to Costco to restock the fridge after last week’s two-day voluntary power outage by PG&E. Expecting Armageddon, I finished off all the Jack Daniels and chocolate in the house. We managed to eat all of our frozen burritos, pork chops, steaks, and ice cream in a mere 48 hours. But that’s what happens when you have two teenagers.

Hopefully, it will rain soon for the first time in six months bringing these outages to an end.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

October 7, 2019

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or WILL HE OR WON’T HE?)

(INDU), (USO), (TM), (SCHW), (AMTD), (ETFC), (SPY), (IWM), (USO), (WMT), (AAPL), (GOOGL), (SPY), (C)

Once again, the markets are playing out like a cheap Saturday afternoon matinee. We are sitting on the edge of our seats wondering if our hero will triumph or perish.

The same can be said about financial markets this week. Will a trade deal finally get inked and prompt the Dow Average to soar 2,000 points? Or will they fail once again, delivering a 2,000-point swan dive?

I vote for the latter, then the former.

Still, I saw this rally coming a mile off as the Trump put option kicked in big time. That's why I piled on an aggressive 60% long position right at last week’s low. Carpe Diem. Seize the Day. Only the bold are rewarded.

Or as Britain’s SAS would say, “Who dares, wins.”

It takes a lot of cajones to trade a market that hasn’t moved in two years, let alone take in a 55% profit during that time. But you didn’t hire me to sit on my hands, play scared, and catch up on my Shakespeare.

I think markets will eventually hit new all-time highs sometime this year. The game is to see how low you can get in before that happens without getting your head handed to you first.

Last week saw seriously dueling narratives. The economic data couldn’t be worse, pointing firmly towards a recession. But the administration went into full blown “jawbone” mode, talking up the rosy prospects of an imminent China trade deal at every turn.

This was all against a Ukraine scandal that reeled wildly out of control by the day. Is there a country that Trump DIDN’T ask for assistance in his reelection campaign? Now we know why the president was at the United Nations last week.

The September Nonfarm Payroll Report came in at a weakish 136,000, with the Headline Unemployment rate at 3.5%, a new 50-year low.

Average hourly earnings fell. Apparently, it is easy to get a job but impossible to get a pay raise. July and August were revised up by 45,000 jobs.

Healthcare was up by 39,000 and Professional and Business Services 34,000. Manufacturing fell by 2,000 and retail by 11,0000. The U-6 “discouraged worker” long term unemployment rate is at 6.9%.

The US Manufacturing Purchasing Managers Index collapsed in August from 49.7 to 47.9, triggering a 400-point dive in the Dow average. This is the worst report since 2009. Manufacturing, some 11% of the US economy, is clearly in recession, thanks to the trade war-induced loss of foreign markets. A strong dollar that overprices our goods doesn’t help either.

The Services PMI Hit a three-year low, from 53.1 to 50.4, with almost all economic data points now shouting “recession.” The only question is whether it will be shallow or deep. I vote for the former.

Consumer Spending was flat in August. That’s a big problem since the average Joe is now the sole factor driving the economy. Everything else is pulling back. Consumer spending, which accounts for more than two-thirds of U.S. economic activity, edged up 0.1% last month as an increase in outlays on recreational goods and motor vehicles was offset by a decrease in spending at restaurants and hotels.

The Transports, a classic leading sector for the market, have been delivering horrific price action this year giving up all of its gains relative to the S&P 500 since the 2009 crash.

Oil (USO) got crushed on recession fears, down a stunning 19.68% in three weeks. The global supply glut continues. Over production and fading demand is not a great formula for prices.

Toyota Auto Sales (TM) cratered by 16.5% in September, to 169,356 vehicles in another pre-recession indicator. It’s the worst month since January during a normally strong time of the year. The deals out there now are incredible.

Online Brokerage stocks were demolished on the Charles Schwab (SCHW) move to cut brokerage fees to zero. TD Ameritrade (AMTD) followed the next day and was spanked for 23%, and E*TRADE (ETFC) punched for 17. These are cataclysmic one0-day stock moves and signal the end of traditional stock brokerage.

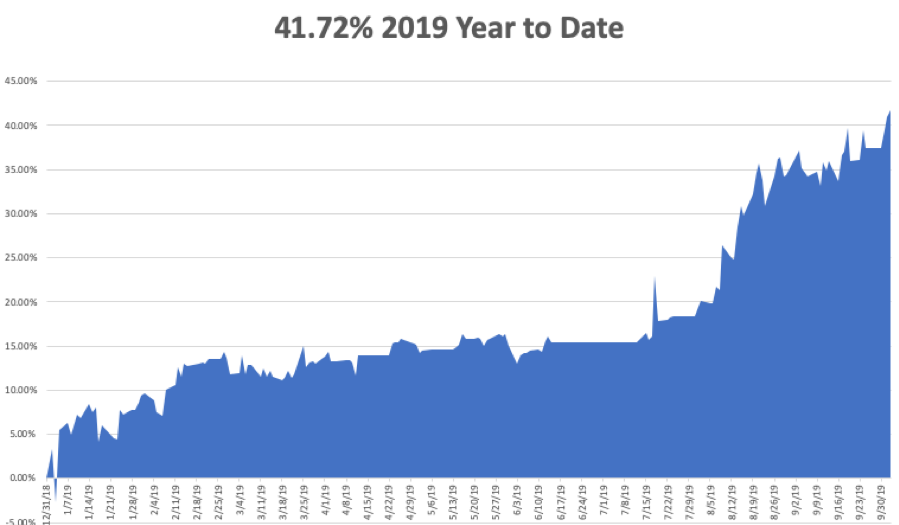

The Mad Hedge Trader Alert Service has blasted through to yet another new all-time high. My Global Trading Dispatch reached new apex of 341.86% and my year-to-date accelerated to +41.72%. The tricky and volatile month of October started out with a roar +5.40%. My ten-year average annualized profit bobbed up to +35.06%.

Some 26 out of the last 27 trade alerts have made money, a success rate of 96.29%! Under promise and over deliver, that's the business I have been in all my life. It works.

I used the recession-induced selloff since October 1 to pile on a large aggressive short dated portfolio. I am 60% long with the (SPY), (IWM), (USO), (WMT), (AAPL), and (GOOGL). I am 20% short with positions in the (SPY) and (C), giving me a net risk position of 40% long.

The coming week is all about the September jobs reports. It seems like we just went through those.

On Monday, October 7 at 9:00 AM, the US Consumer Credit figures for August are out.

On Tuesday, October 8 at 6:00 AM, the NFIB Business Optimism Index is released.

On Wednesday, October 9, at 2:00 PM, we learn the Fed FOMC Minutes from the September meeting.

On Thursday, October 10 at 8:30 AM, the US Inflation Rate is published. US-China trade talks may, or may not resume.

On Friday, October 11 at 8:30 AM, the University of Michigan Consumer Sentiment for October is announced.

The Baker Hughes Rig Count is released at 2:00 PM.

As for me, I’m still recovering from running a swimming merit badge class for 60 kids last weekend. Some who showed up couldn’t swim, while others arrived with no swim suits, prompting a quick foray into the lost and found.

One kid jumped in and went straight to the bottom, prompting an urgent rescue. Another was floundering after 15 yards. When I pulled him out and sent him to the dressing room, he started crying, saying his dad would be mad. I replied, “Your dad will be madder if you drown.”

I never felt so needed in my life.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

October 4, 2019

Fiat Lux

Featured Trade:

(LAST CHANCE TO BUY THE NEW MAD HEDGE BIOTECH AND HEALTH CARE LETTER AT THE FOUNDERS PRICE)

(SEPTEMBER 18 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPY), (VIX), (USO), (ROKU), (TLT), (BA), (INDU),

(GM), (FXI), (FB), (SCHW), (IWM), (AMTD)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader October 2 Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: Would you do the S&P 500 (SPY) bull call spread if you didn’t have time to enter the short leg yesterday?

A: I would, because once again, once the Volatility Index (VIX) gets over $20, picking these call spreads is like shooting fish in a barrel. I think the long position I put on the (SPY) this morning is so far in the money that you will be sufficiently safe on a 12-day and really a 2-week view. There is just too much cash on the sidelines and interest rates are too low to see a major December 2018 type crash from here.

Q: I could not come out of the United States Oil Fund (USO) short position—should I keep it to expiration?

A: Yes, at this point we’re so close to expiration and so far in the money that you’d need a 30% move in oil to lose money on this. So, run it into expiration and avoid the execution costs.

Q: How do you see TD Ameritrade (AMTD) short term?

A: Well, it was down approximately 25% yesterday, so I would buy some cheap calls and go way out of the money so as not to risk much capital—on the assumption that maybe next week into the China trade talks, we get some kind of rally in the market and see a dramatic rise. 25% does seem extreme for a one-day move just because one broker was cutting his commissions to zero. By the way, I have been predicting that rates would go to zero for something like 30 years; that’s one of the reasons I got out of the business in 1989.

Q: Would you consider buying Roku (ROKU) at the present level?

A: Down 1/3 from the top is very tempting; however, I’m not in a rush to buy anything here that doesn’t have a large hedge on it. What you might consider doing on Roku is something like a $60-$70 or $70-$80 long-dated call spread. That is hedged, and it’s also lower risk. Sure, it won’t make as much money as an outright call option but at least you won’t be catching a falling knife.

Q: Will we see a yearend rally in the stocks?

A: Probably, yes. I think this quarter will clear out all the nervous money for the short term, and once we find a true bottom, we might find a 5-10% rally by yearend—and I’m going to try to be positioned to catch just that.

Q: At which price level do you go 100% long position?

A: If we somehow get to last December lows, that’s where you add the 100% long position. And there is a chance, while unlikely, that we get down to about 22,000 in the Dow Average (INDU), and that’s where you bet the ranch. Coming down from 29,000 to 22,000, you’re essentially discounting an entire recession with that kind of pullback. But we’re going to try to trade this thing shorter term; the market has so far been rewarding us to do so.

Q: The United States Treasury Bond Fund (TLT) looks like it’s about to break out. How do you see buying for the November $145 calls targeting $148?

A: We are actually somewhat in the middle of the range for the (TLT), so it’s a bit late to chase. We did play from the long side from the high $130s and took a quick profit on that, but now is a little bit late to play on the long side. We go for the low-risk, high-return trades, and $145 is a bit of a high-risk trade at this point. I would look to sell the next spike in the (TLT) rather than buy the middle where we are now.

Q: Will Boeing (BA) get recertified this year?

A: Probably, yes—now that we have an actual pilot as the head of the FAA—and that will be a great play. But if the entire economy is falling into a recession, nothing is a good play and you want to go into cash if you can’t do shorts. That would give us a chance to buy Boeing back closer to the $320 level, which was the great entry point in August.

Q: Do you expect General Motors (GM) shares to bounce if they settle with the union on their strike?

A: Maybe for a day or two, but that’s it. The whole car industry is in recession already. The union picked the worst time to strike because GM has a very high 45-day inventory of unsold cars which they would love to get rid of.

Q: What are the chances of a deal with China (FXI)?

A: Zero. How hard do the Chinese really want to work to get Trump reelected? My guess is not at all. We may get the announcement of a fake deal that resumes Chinese agricultural purchases, but no actual substance on intellectual property theft or changing any Chinese laws.

Q: Will they impeach Trump?

A: Impeach yes, convict no; and it’s going to take about 6 months, which will be a cloud hanging over the market. The market’s dropped about 1,000 points since the impeachment inquiry has started.

Q: What about the dollar?

A: I'm staying out of the dollar due to too many conflicting indicators and too much contra-historical action going on. The dollar seems high to me, but I’ve been wrong all year.

Q: E*Trade (ETFC) just announced free stock trading—what are your thoughts?

A: All online brokers now pretty much have to announce free trading in order to stay in business, otherwise you end up with the dumbest customers. It’s bad for the industry, but it’s good for you. The fact that all of these companies are moving to zero shows how meaningless your commissions became to them because so much more money was being made on selling your order flow to high frequency traders or selling your data to people like Facebook (FB).

Q: What’s your take on the Canadian dollar (FXC)?

A: It will go nowhere to weak, as long as the US is on a very slow interest rate-cutting program. The second Canada starts raising rates or we start cutting more aggressively is when you want to buy the Loonie.

Q: Fast fashion retailer Forever 21 went bankrupt—is it too late to short the mall stocks?

A: No but be very disciplined; only short the rallies. Last week would have been a good chance to get shorts off in malls and retailers. You really need to sell into rallies because the further these things go down, the more volatility increases as the prices go low. Obviously, a $1 move on a $30 stock is only 3% but a $1 move on a $10 stock is 10%. If you’re the wrong way on that, it can cost you a lot of money, even though the thing’s going to zero.

Q: Comments on defense stocks such as Raytheon (RTN)?

A: This is a highly political sector. If Trump gets reelected, expect an expansion of defense spending and overseas sales to Saudi Arabia, which would be good for defense. If he doesn’t get reelected, that would be bad for defense because it would get cut, and sales to places like Saudi Arabia would get cut off. I stay out of them myself because it’s essentially a political play and we’re very late in the cycle.

Q: Mark Zuckerberg says presidential candidate Elizabeth Warren’s proposal is an existential threat. Do you agree with him and her policies? Will they crash the economy?

A: They would be bad for the economy; however, I think it’s highly unlikely Warren gets elected. The country’s looking for a moderate president, not a radical one, and she does not fit that description. If you did break up the Tech companies, they’d be worth more individually than they are in these great monolithic companies.

Q: Does the Russell 2000 (IWM) call spread look in danger to you?

A: It’s a higher risk trade, however we are hedged with that short S&P 500, so we can hang onto the long (IWM) position hedging it with your short S&P 500 (SPY) trade reducing your risk.

Q: What do you have to say about shrinking buybacks?

A: It’s another recession indicator, for one thing. Corporate buybacks have been driving the stock market for the last 2 years at around a trillion dollars a year. They have suddenly started to decline. Why is that happening? Because companies think they can buy their stocks back at lower levels. If companies don't want to buy their stocks, you shouldn’t either.

Q: When is the time for Long Term Equity Anticipation Securities (LEAPS)?

A: We are not in LEAPS territory yet. Those are long term, more than one-year option plays. You really want to get those at the once-a-year horrendous selloffs like the ones in December and February. We’re not at that point yet, but when we get there, we’ll start pumping out trade alerts for LEAPS for tech stocks like crazy. Start doing your research and picking your names, start playing around with strikes, and then one day, the prices will be so out of whack it will be the perfect opportunity to go in and buy your LEAPS.

Q: Was it a Black Monday for brokerages when Charles Schwab (SCHW) cut their commission to zero?

A: Yes, but it’s been one of the most predicted Black Mondays in history.

Q: Will the Fed save the market?

A: I would think they have no ability to save the market because they really can’t cut interest rates any more than they already have. There really are no companies that need to borrow money right now, and any that does you don’t want to touch with a ten-foot pole. The economy is not starved for cash right now—we have a cash glut all over the world—therefore, lowering interest rates will have zero impact on the economy, but it does eliminate the most important tool in dealing with future recessions. You go into a recession with interest rates at zero, then you’re really looking at a great depression because there’s no way to get out of it. It’s the situation Europe and Japan have been in for years.

Good Luck and Good Trading

John Thomas

CEO $ Publisher

The Diary of a Mad Hedge Fund Trader

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.