First, Apple (APPL) collaborates with Goldman Sachs’ (GS) offering of a credit card even giving credit access to subprime borrowers.

And now Google (GOOGL) has its eyes on the banking industry — specifically, it’ll soon offer checking accounts.

In a copycat league where anything and everything is fair game, we are seeing a huge influx of big tech companies vie for the digital wallets of Americans.

The project is aptly named Cache and accounts will be handled by Citibank (C) and a credit union at Stanford.

Google’s spokesman shared with us admitting that Google hopes to “partner deeply with banks and the financial system,” and further added, “If we can help more people do more stuff in a digital way online, it’s good for the internet and good for us.”

I would disagree with the marginal statement that it would be good for us.

Facebook (FB) is now offering a Pay option and how long will it be until Amazon (AMZN), Microsoft (MSFT), and others throw their name into the banking mix.

I believe there will be some monumental failures because it appears that these tech companies won’t offer anything that current bank intuitions aren’t offering already.

Moving forward, the odd that digital banking products will become saturated quickly is high.

Let’s cut to the chase, this is a pure data grab, and not in the vein of offering innovative services that force the consumer down a revolutionary product experience.

As the consumer starts to smarten up, will they happily reveal every single data point possible to these tech companies?

Big tech continues to be adamant that personal data is secure with them, but their track records are pitiful.

Even if Google doesn’t sell “individual data”, there are easy workarounds by just slapping number tags on aggregated data, then aggregated data can be reverse-engineered by extracting specific data with number tags.

The cracks have already started to surface, Co-Founder of Apple Steve Wozniak has already claimed that the credit algorithm for Apple’s Goldman Sach’s credit card is sexist and flawed.

Time is ticking until the first mass data theft as well and let me add that the result of this is usually a slap on the wrist incentivizing bad behavior.

I believe big tech companies should be banned from issuing banking products.

Only 4% of consumers switched banks last year, and a 2017 survey by Bankrate shows that the average American adult keeps the same checking account for around 16 years.

As anti-trust regulation starts to gather more steam, I envision lawmakers snuffing out any and every attempt for big tech to diversify into fintech.

It’s fair to say that Google should have done this 10 years ago when the regulatory issues were nonexistent.

Now they have regulators breathing down their necks.

Let me remind readers that the reason why Facebook abandoned their digital currency Libra was because of the pressure lawmakers applied to every company interesting in working with Facebook’s Libra.

Lawmakers threatened Visa and Mastercard that they would investigate every part of their business, including the parts that have nothing to do with Facebook’s Libra, if they went ahead with the Libra project.

The most telling insight comes from the best tech company Microsoft who has raised the bar in terms of protecting their reputation on data and trust.

They decided to stay away from financial products like the black plague.

Better to stay in their lane than take wild shots that incur unneeded high risks.

When U.S. Senator Mark Warner, a Democrat on the Senate panel that oversees banking, was asked about Google and banking, he quipped, “There ought to be very strict scrutiny.”

Big tech is now on the verge of getting ferociously regulated and that could turn out positive for the big American banks, PayPal (PYPL), Visa (V), Mastercard (MA) and Square (SQ).

I heavily doubt that Google will turn Cache into a meaningful business unless Google offers some jaw-dropping interest rates or elevated points to move the needle.

Google has canceled weekly all-hands meetings because of the tension between staff members and Facebook is also just as dysfunctional at the employee level.

Whoever said it's easy to manage a high-stake, too-big-to-fail tech firm?

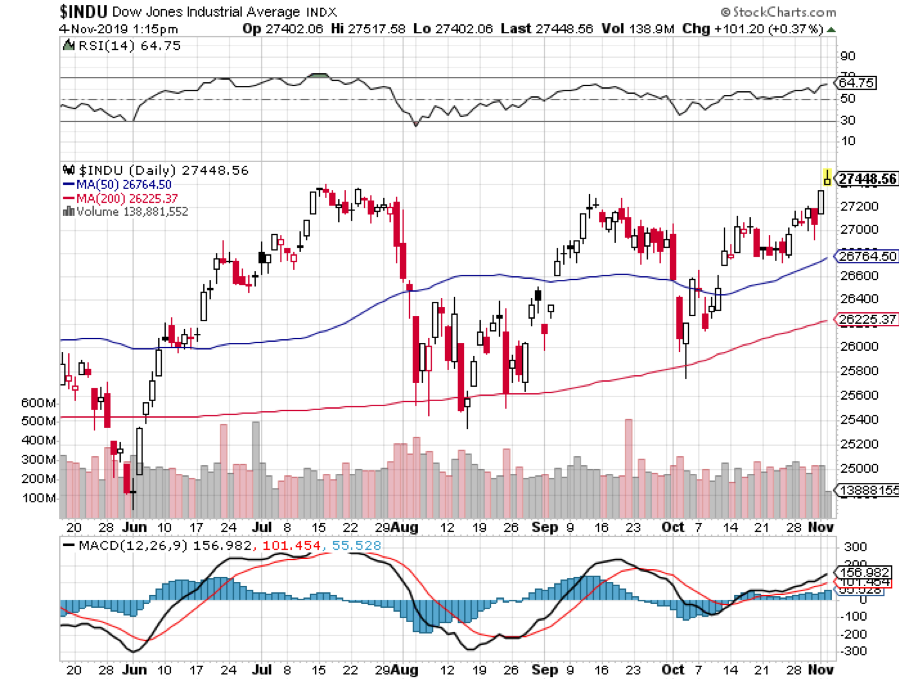

Even with all the negativity, Google is still a cash cow and if regulatory headwinds are 2-3 years off, they are a buy and hold until they are not.

The recent tech rally, after the rotation to value, has seen investors flood into Apple, Microsoft, and Google as de-facto safe haven tech plays.