Google Translate, Alphabet's (GOOGL) free, multilingual machine, foreign language translation service, translates an unimaginable143 billion words per day.

These were one of the pearls divulged in the conference call from Google's CEO Sundar Pichai.

A bump in usage coincided with the 2018 World Cup in Russia, and in the age of low-cost airfare and overpopulation, it could be Alphabet's new cash cow.

Google Translate has the potential to morph into one of the premier foreign language applications used by anyone and everyone.

Forget about the Amazon effect, the Alphabet effect could be just as pungent, albeit away from the trenches of e-commerce.

Thank goodness the application is still ad-free.

No doubt it would be inconvenient to sit through a 15 second ad while interacting with a concierge at a bed and breakfast in the South of France.

Analysts did not sound out Pichai's plans for Google Translate, but he did mention there are some monetization opportunities on the horizon.

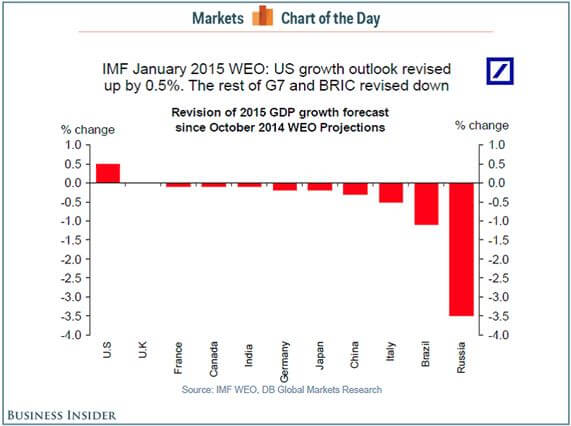

The latest earnings report is the most recent indication that the FANGs along with Microsoft are pulling away from the rest.

The equity price action in 2018 vindicates this fact with more than 80% of the gains spread around just a few high caliber tech names.

Is this fair? No. But life isn't fair.

The too slow too late regulation that was supposed to put a cap on the vaunted FANG group has had the opposite effect, squeezing the small guy out of the picture.

The runway is all clear for the FANGs, and the only way they will be stopped is if they stop themselves or an antitrust ruling.

This all adds up to why Alphabet has been a perennial recommendation for the Mad Hedge Technology Letter.

Duopolies are few and far between and monopolies even rarer.

They are great for earnings and as the global digital ad pie grows, it falls down to Google's bottom line.

On the news of stellar earnings, Facebook shares jumped higher in aftermarket trading and powered on to trade around 5% the following day.

Expect a great earnings report from Facebook with robust ad revenue growth.

Nothing less would be a failure of epic proportions.

The migration to mobile is real and investors need to understand analysts cannot keep up with the rising year-end targets in these shares.

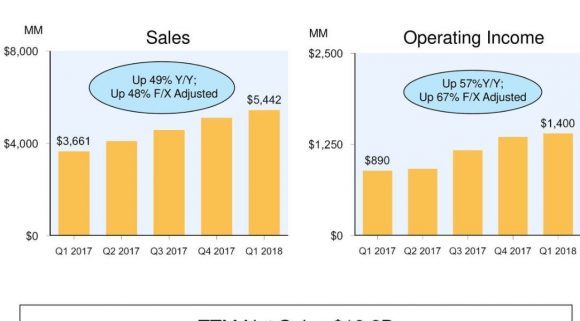

Alphabet had a high bar over which to pole vault, and it still managed to beat it handily.

And the $5 billion fine for bundling its in-house apps on Android fell on deaf ears.

Alphabet has $102 billion in the coffers, and $5 billion will do nothing to materially affect the company.

The cash reserves are up from $34 billion in 2010.

The market trampled on any sniff of a risk-adverse sentiment and powered into the green with the Nasdaq reaching another all-time high.

Let's not get too carried away. Alphabet's bread and butter is still its digital ad business with Alphabet CFO Ruth Porat confirming this fact saying, "One of the biggest opportunities for investment continues to be in our ads business."

Alphabet still breaks off 86% of revenue from its distinguished ad business.

"Other" is a category commingling Google Cloud, Google Play, and hardware that only comprised 13 percent of total revenue.

"Other Bets" brings up the rear with 1% of total revenue comprising Waymo, Alphabet's self-driving unit, which is an industry leader putting Tesla and Uber in their place.

Waymo plans to shortly roll out a massive commercial operation. Along with Google Translate, it could carve out a nice position in Alphabet's portfolio going forward.

The most important metric was Alphabet's total ad revenue, which it locked in at $28.1 billion, a 23.9% YOY improvement.

Aggregate paid clicks, a model in which the advertiser pays Google for a user to click an ad, has been steadily rising to 58%, up from 52% from the same time last year.

The masterful efficiency circles back to Google's ad tech team, which is by far the best in the business and has outstanding management.

The Cloud is an area that Alphabet highlights as a place for improvement.

Alphabet's cash war chest allows the company to throw hoards of cash at a problem. When mixed with brilliant management it usually works out kindly.

CFO Porat mentioned that costs were particularly higher in the quarterly head count because of large investments in cloud talent.

Google is tired of playing third fiddle to Amazon (AMZN) and Microsoft (MSFT), and views enhancing the enterprise business as imperative.

This explains Alphabet's head count surge to more than 89,000 employees, sharply higher than the 75,600 employed a year earlier.

Every FANG and high-tier tech company is spending its brains out to compete with each other.

Expanding data centers is not cheap. Neither are the people to deploy it.

Alphabet has the cash to compete with the Amazons and Apples (AAPL) of the world.

They do not have to borrow.

The potential trip wire in Alphabet's earnings report was Google's traffic acquisition cost (TAC).

Alphabet's (TAC) is described as money paid to other companies to direct user traffic to its suite of Google products.

(TAC) went up to $6.4 billion, which is 23% of Google's ad revenue but down on a relative percentage basis of 24%.

This was enough to keep investors from sounding the alarm and was welcomed by analysts.

Alphabet pulled out all the stops this quarter and the momentum is palpable.

Top-line growth from its core ad business shows no sign of slowing.

Acceptable (TAC) was the cherry on the sundae for the quarter at a time when many industry insiders thought it would be around 25% or higher.

Hardware offered less punch than before, which is what all high-quality tech companies desire.

There were no obvious weaknesses and the 34 straight quarters of 23% YOY growth is hard to top.

Google pulls in 10% of all global digital ad dollars in one business.

Other highlights were Waymo eclipsing the 8-million-mile mark of self-driving on public roads as it is the next business to come to the fore.

Google cloud is at an inflection point attempting to win over corporate management.

It has already won contracts with heavy hitters such as Twitter (TWTR) and Disney (DIS).

Pichai mentioned Target (TGT) as a key new cloud client that just signed on with Google last quarter.

More importantly, Alphabet's brilliant quarter bolsters the macroeconomic picture heavily reliant on tech earnings to usher the market through the gauntlet.

Regulation has proved irrelevant. Whatever fine they are slapped with does not change that Google reaps the benefits from its market position as one of the duopolies in the global ad business.

Alphabet has been trading from the bottom left to the upper right via a consistent channel.

Do not chase the new all-time high of $1,270. Use any weakness around the $1,100 level to initiate new positions.

Owning a company this dominant has little downside. The regulatory burden was a myth and Pichai has handled this operation beautifully.

I am bullish on Alphabet and its partner in crime Facebook.

________________________________________________________________________________________________

Quote of the Day

"Man is still the most extraordinary computer of all," said the 35th President of the United States John F. Kennedy.