As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

A few years ago, I went to a charity fund raiser at San Francisco's priciest jewelry store, Shreve & Co., where the well-heeled men bid for dates with the local high society beauties, dripping in diamonds and Channel No. 5. Well fueled with champagne, I jumped into a spirited bidding war for one of the Bay Area's premier hotties, who shall remain nameless. She?s happily married to a tech titan now, and gentlemen don?t tell. Suffice it to say, she has a sports stadium named after her.

The bids soared to $10,000, $11,000, $12,000. After all, it was for a good cause. But when it hit $12,400, I suddenly developed lockjaw. Later, the sheepish winner with a severe case of buyer's remorse came to me and offered his date back to me for $12,000.? I said ?no thanks.? $11,000, $10,000, $9,000?? I passed.

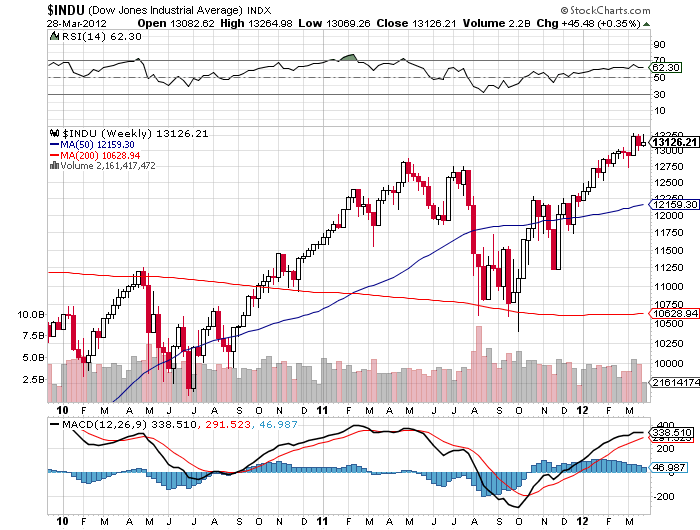

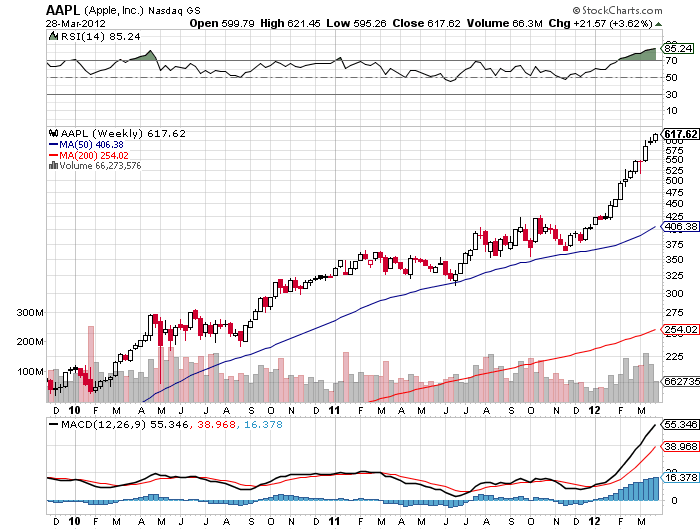

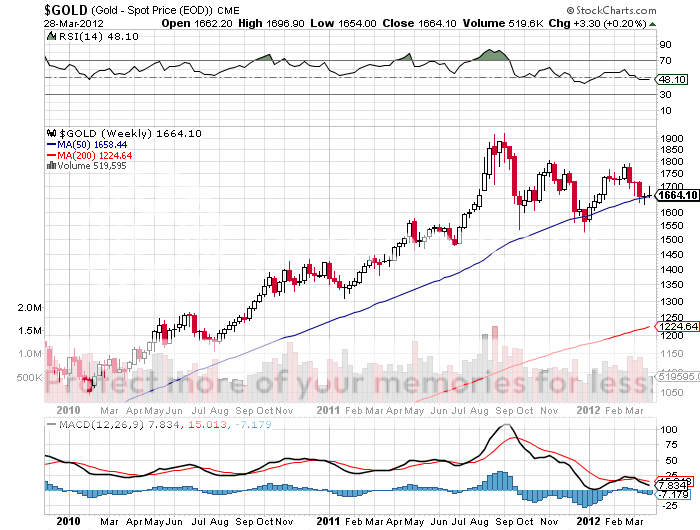

The current altitude of the stock market reminds me of that evening. If you rode gold (GLD) from $800 to $1,900, oil, from $35 to $110, and Apple (AAPL) from $200 to $610, why sweat trying to eke out a few more basis points, especially when the risk/reward ratio sucks so badly, as it does now? I have a feeling that those who loaded up on stocks in March may develop the same sort of buyer?s remorse that I witnessed at Shreve?s.

I realize that many of you are not hedge fund managers, and that running a prop desk, mutual fund, 401k, pension fund, or day trading account has its own demands. But let me quote what my favorite Chinese general, Deng Xiaoping, once told me, ?There is a time to fish, and a time to hang your nets out to dry.?

At least then I'll have plenty of dry powder for when the window of opportunity reopens for business. So while I'm mending my nets, I'll be building new lists of trades for you to strap on when the sun, moon, and stars align once again.

See Any Similarity?

Time to Mend the Nets

ETF's are much more attractive than mutual fund competitors, with their notoriously bloated expenses and spendthrift marketing costs. You can't miss those glitzy, overproduced, big budget ads on TV for a multitude of mutual fund families. You know, the ones with the senior couple holding hands walking down the beach into the sunset, the raging bulls, etc? You are the sucker who is paying for these. Sometimes I confuse them for Viagra commercials.

I once did a comprehensive audit on a mutual fund, and a blacker hole you never saw. There were so many conflicts of interest it would have done Bernie Madoff proud. Any trainee assistant trader can tell you that more than 90% of all mutual fund managers reliably underperform the indexes, some grotesquely so. Published performance is bogus, they show a huge survivor bias, not including the hundreds of mutual funds that close each year. And there's always that surprise tax bill at the end of the year.

If there was ever an industry crying out for a fundamental restructuring, consolidation, price competition, and ultimately a whopping great downsizing, it is the US mutual fund industry. ETF's may be the accelerant that ignited this epochal sea change, with the number of mutual funds recently having shrunk from 10,000 to 8,000. It's still early days, with ETF's only accounting for 5-6% of trading volume, even though they have been around for a decade.

The Mutual Fund's Days Are Numbered

After my year in the White House Press Corps, I vowed never to return, and took a really long shower, hoping to scrub every last spec of prejudice, self-interest, and institutionalized dishonesty off of my battered carcass. But sometimes I see some maneuvering that is so unprincipled, crooked, and against the national interest that I am unable to restrain my fingers from the keyboard.

I?m talking about the absolutely merciless hatchet job the coal producers are inflicting on the natural gas industry. Coal today accounts for 50% of America?s 3.7 trillion kilowatts in annual power production. Chesapeake Energy?s (CHK) Aubrey McClendon says correctly that if we just shut down aging conventional power plants over 35 years old, and replace them with modern gas fired plants, the US would achieve one third of its ambitious 2020 carbon reduction goals.

The share of relatively clean burning natural gas of the national power load would pop up from the current 23% to 50%. Even the Sierra Club says this is the fastest and cheapest way to make a serious dent in greenhouse gas emissions. So what do we get?

The press has recently been flooded with reports of widespread well poisonings and forest destruction caused by the fracking processes that recently discovered a new 100 year supply of ultra-cheap CH4. The YouTube images of flames shooting out of a kitchen faucet are well known. But MIT did a study investigating over 50 of these claims and every one was found to be due to inexperienced subcontractor incompetence, not the technology itself. The demand for these wells is so great that it is sucking in neophytes into bidding for contracts, whether they know how to do it or not.

While the coal industry has had 200 years to build a formidable lobby in Washington, the gas industry is just a beginner, their only public champions being McClendon and T. Boone Pickens. Every attempt they have made to get a bill through congress to speed up natural gas conversion has been blocked not by environmentalists, but other conflicted energy interests.

Memories in Washington are long, and Obama & Co. recall all too clearly that this was the pair that financed the Swift Boat Veterans for Truth that torpedoed Democrat John Kerry?s 2004 presidential campaign. What goes around comes around.

This will be unhappy news for the 23,000 the American Lung Association expects coal emissions to kill this year. Can?t the coal industry be happy selling everything they rip out of the ground to China?

There! I?ve had my say. Now I?m going to go have another long shower.

Time to Take That Shower

I am getting tired of the endless procession of perma bulls who keep insisting that, at a 14 times multiple, the S&P 500 is cheap. The last time I heard this was in 2000, when NASDAQ multiples went from 100 to 50, on their way to 10. Before that, it was in Japan in 1990, when multiples went from, guess what, 100 to 50 on their way to 10. Some 20 years later, Japanese multiples are still at a lowly 15.

When I first entered the stock business in the seventies, typical equity earnings multiples were in the seven to eight neighborhood. If you performed exhaustive stock screens, which then involved paging through endless reams of 10-k's, newsletters, and tip sheets printed in impossibly small type, you could occasionally find something at a two multiple, the kind Graham and Dodd wrote about. Anything over ten was considered outrageously overpriced, fit only to be sold on to retail investors. This is when the prime rate was at 6%.

The weakness we saw this week is consistent with my long term view that we are permanently downshifting from a 3.9% to a 2%-2.5% growth rate, and the lower multiples this deserves. I'm convinced that if the circuit breakers had not been installed, we would have been visited by another flash crash last week. If you look at a 30 year range of market multiples, it ranges from 10-22. Given our flaccid growth prospects going forward, I think the new range will be 10-16. It doesn?t make today's 14 multiple look like such a bargain.

?The luckiest person in the world today is the baby being born in the United States. The outlook for this country is fantastic,? said Warren Buffet.

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

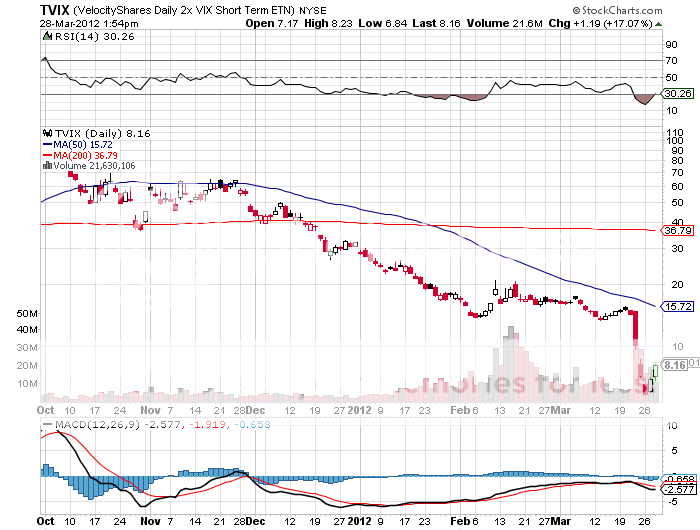

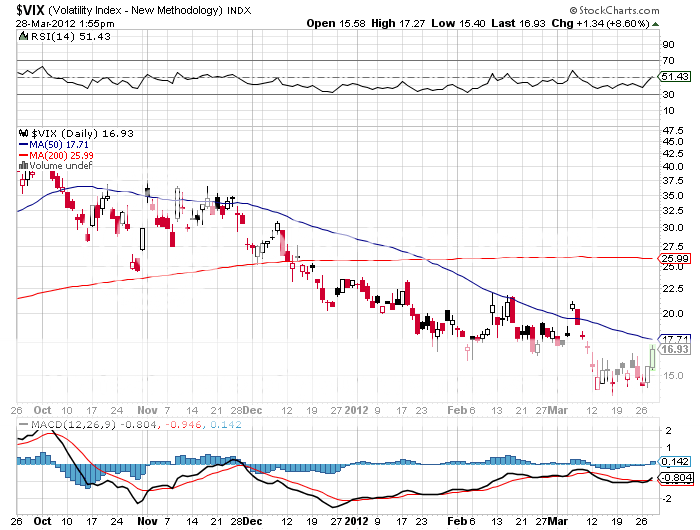

The inside story on the collapse of volatility is now out, and as a result, managers are reviewing the harsh lessons learned and tweaking their strategies. It highlights the dangers of buying securities without reading the prospectus and understanding what is under the hood.

As investors piled into stocks in February, they also bought downside protection in the form of the Velocity Shares Daily 2X VIX Short Term ETN (TVIX). For reasons that are yet to be explained, the issuer, Credit Suisse, arbitrarily decided to quit issuing new shares, effectively turning this vehicle into a closed end fund. Money poured in anyway, driving the price up to a 100% premium over the intrinsic value of the fund.

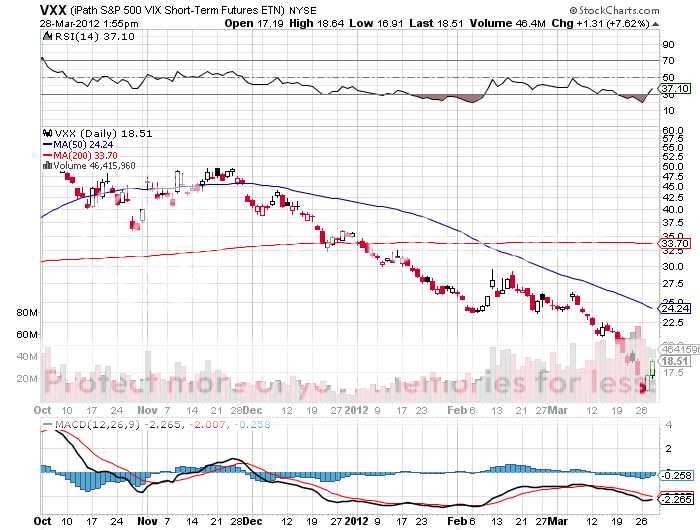

Then, out of the blue, Credit Suisse reversed its decision and decided to issue new shares after all last week. This could mean only one thing to the professional volatility trading community, which jumped on the (TVIX) with both feet. They took the ETF down a stunning 65% in a week, all the way down to a 20% discount to intrinsic value. During the same time, the (VXX) fell by 25%, while the (VIX) was up 10%. Now that?s a tracking error with a turbocharger!

It now appears that there was some advanced knowledge about the reissuance of shares, and the SEC is almost certain to make inquiries. Those who had hoped for downside protection in the stock market got a slap in the face instead. To say the least, confidence in the financial system has not been advanced.

To make matters worse, a major hedge fund based in Chicago has a gigantic position in the (TVIX) with a ?put tree?. This involved buying one $21 put and selling short one $18 put and three $17 puts. Below $17 they were 300% long the (TVIX). When the ETF broke that level, the sushi hit the fan, triggering panic selling of all (VIX) products at any price, including the unrelated (VXX). I can?t tell you who it is without risking litigation. But with the quarter end upon us, their investors will find out soon enough. Watch the newspapers to find out whom.

The debacle has sent analysts scurrying to find other ETF?s that may be trading at premiums to their underlying. Here are the top three:

Platinum (PGM) 27%

Municipal bonds (GMMG) 14%

China small cap (PEK) 6%

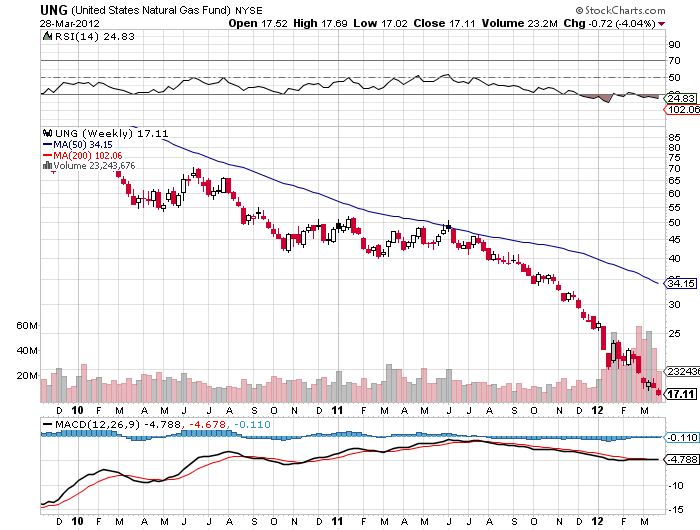

The premium in the (UNG) frequently goes as high as 50% and results from the contango in the futures market, where far month contracts are trading at big premiums to the front month. That makes it a great shorting vehicle in falling markets, because the ETF always falls faster than the underlying. I have drunk at this well many times.

What happens from here? My guess is now that managers see that their downside protection is a sham, they won?t want to play. That could translate into stock selling, now that holders understand that these positions involved more risk than they realized.

In the meantime, if you plan on dabbling in the $1.4 trillion 1,400 issue ETF market, it may prove wise to check out the intrinsic value of any ETF before you buy it. You can do this easily by going to Yahoo Finance and adding .iv to any ticker symbol. So while the (TVIX) intrinsic value this second is at $7.51, the current market is at $7.96, a 6% premium. If you value your wealth, you might well get familiar with this exercise.

Trading Volatility Isn?t Always So Fun

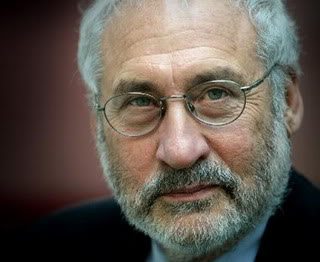

The great thing about interviewing Joseph Stiglitz over dinner is that you don?t have to ask any questions. You just turn him on and he spits out one zinger after another. And he does this in a kibitzing, wizened, grandfatherly manner like one would expect from a character that just walked off the set of Fiddler on the Roof. The unfortunate thing is that you also don?t get to eat. The Columbia University professor and former World Bank Chief Economist animatedly talked the entire time, and I was too busy feverishly taking notes to ingest a single crouton.

Stiglitz argued that for 30 years after the end of the Great Depression there was no financial crisis because a newly empowered SEC was on the beat, and everything worked. A deregulation trend that started under Reagan began stripping away those protections, with the eventual disastrous repeal of Glass-Steagle in 1999. The philosophical justification adopted by many economists, including Fed chairman Alan Greenspan, was that unfettered markets always lead to efficient outcomes.

This belief was based on simplistic models assuming that markets were always perfect, always open, and that everyone had perfect information. Stieglitz?s own work on ?information asymmetry,? which earned him a Nobel Prize in economics in 2001, pulled the rug out from under this theory, because it showed that one party to a transaction always has more information than the other, often the seller.

The banks used this window to introduce super leveraged derivatives that had never been regulated, studied, or even understood. They then clawed open accounting loopholes that were so imaginative that not only were shareholders and regulators deceived about how much risk was involved, senior management was clueless as well. Instead of managing risk, they created risk.

A 2006 GDP that was 80% derived from real estate transactions and a savings rate that fell to zero meant that a severe crash was a sure thing. President Bush?s response was to unleash an extreme form of ?trickledown? economics, with the banks given $700 billion with no conditions attached. Intended to recapitalize the banks so they could resume lending to the mainstream economy, much of the money ended up being paid out in bonuses and dividends. Of the $180 billion used to rescue AIG, $13 billion went to Goldman Sachs, and much of the rest went to German and French banks. No wonder Main Street feels cheated.

The financial system is now more distorted than ever, with major institutions wards of the state, and smaller banks that actually lend to consumers and small businesses going under in record numbers, because the playing field is so uneven. There are too many structural conflicts of interest. The ?once in a 100 year tsunami? argument is merely a justification for changing nothing. Banks would rather maintain the fiction that the loans on their books are good, than make adjustments, meaning there will be more foreclosures in 2012 than in 2010 or 2009. No financial system has ever wasted assets on this scale, and the end result will be a national debt many trillions of dollars larger.

The $787 billion stimulus package was too small, and should have been at least $1.2 trillion, but there was no way Obama was going to get more out of this Senate. The 40% of the stimulus that was tax cuts will get saved and create no immediate beneficial effects on the economy. More money should have gone to the states, which unable to deficit spend, are now a huge drag on the economy. But even this meager package was able to prevent the unemployment rate from rising from 10% to 12%, as it was set to do. The inadequacy of the first package means a second is almost a certainty. Any major spending cuts will produce ?Hoover? outcomes.

The outlook for the economy is bleak, at best.

Well, I don?t get to chat at length with a Nobel Prize winner every day, so I thought I?d give you the full blast, even though I had to leave a lot out. I?ll talk more about markets tomorrow.

?Bankers will get away with whatever they can get away with. Our banking system is socially useless,? said an oversight body in the United Kingdom.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.