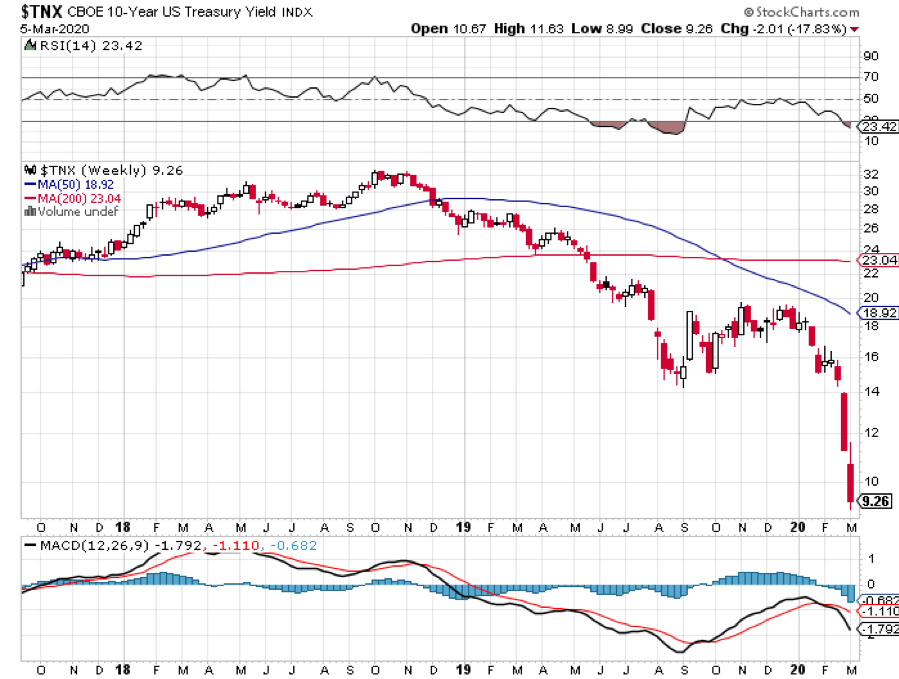

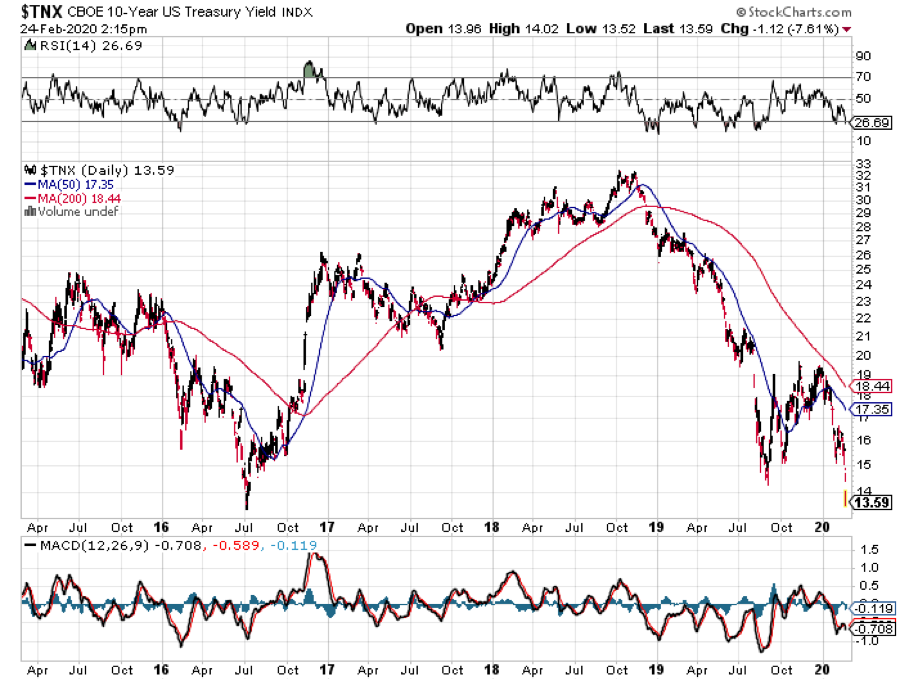

With ten-year US Treasury yields falling below 0.90% today a borrowing rampage of epic proportions is about to ensue. This is not a new thing.

We are, in fact, becoming the United States of Debt.

That Washington is taking the lead in this frenzy of borrowing is undeniable. Since the new administration came into power three years ago, the annual budget deficit has nearly tripled from $450 billion to $1.2 trillion.

Add it all up and the United States government is on track to take the National Debt from $23 trillion to $30 trillion within a decade.

The National Debt exceeded US GDP in 2016, taking the debt to GDP ratio to the highest point since WWII.

Former Fed governor Janet Yellen recently confided to me saying, “It’s the kind of thing that should keep you awake at night.”

It gets worse.

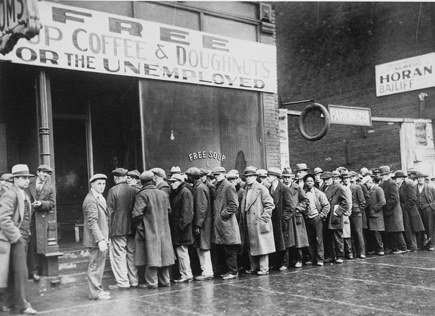

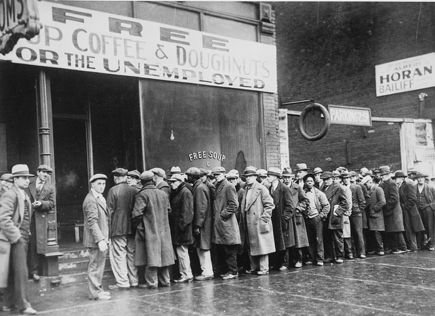

According to the Federal Reserve Bank of New York, total personal debt topped $17 trillion by the end of 2019. An overwhelming share of personal consumption is now funded by credit card borrowing.

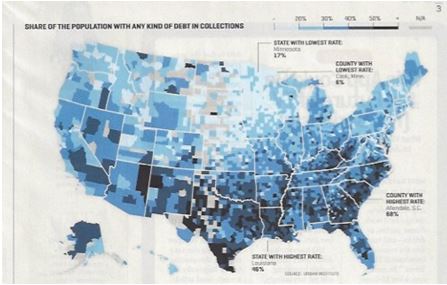

Some 33% of Americans now have debts in some form of a collection and that figure reaches an astonishing 50% in many southern states (see map below). Call it the Confederate States of Debt.

Corporations have also been visiting the money trough with increasing frequency taking their debt to $6.1 trillion, up by 39% in five years, and by 85% in a decade.

The debt to capital ratio of the top 1,000 companies has ballooned from 35% to 54% and is now the highest in 20 years.

Another foreboding indicator is that corporate debt is rising faster than sales, with debt rising by a breakneck 8.5% annualized compared to 4.6% for sales over the past decade.

Automobile debt now tops $1 trillion and with lax standards has become the new subprime market.

And remember that other 800-pound gorilla in the room? Student debt now exceeds $1.6 trillion and is rising, as is the default rate. Provisions in the last tax bill eliminate the deductibility of the interest on student debt making lives increasingly miserable for young borrowers. And you wonder why the US birth rate is so low.

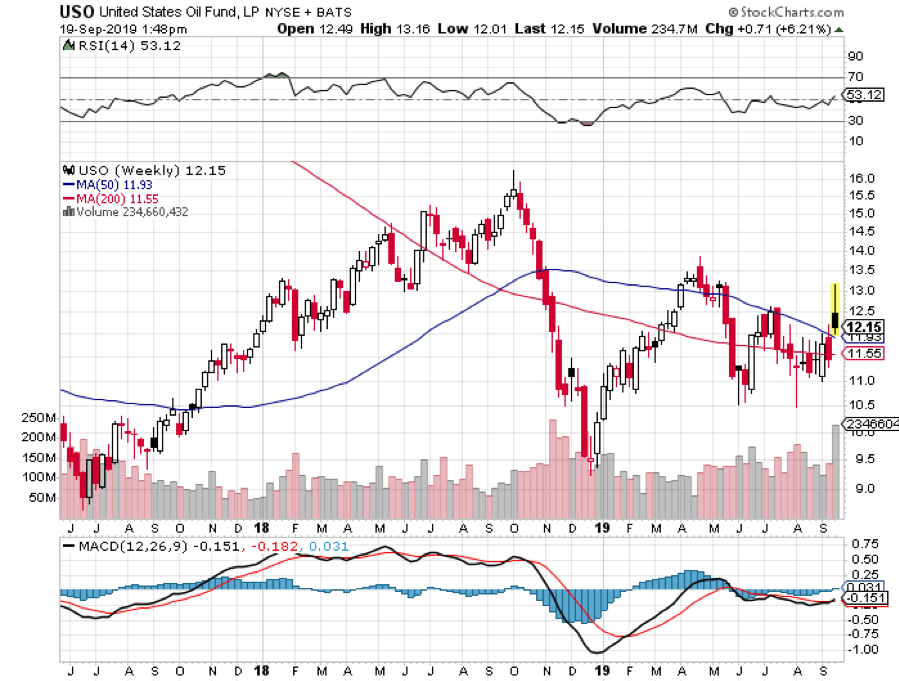

Of course, you can blame the low interest rates that have prevailed for the past decade. Who doesn’t want to borrow when the inflation-adjusted long-term cost of money is FREE?

That explains why Apple (AAPL), with $270 billion in cash reserves held overseas, has been borrowing via ultra-low coupon 30-year bond issues even though it doesn’t need the money. Many other major corporations have done the same.

And while everything looks fine on paper now, what happens if interest rates ever rise?

The Feds will be in dire straight very quickly. Raise short term rates to the 6% seen at the peak of the last cycle and the nation’s debt service rockets from 4% to over 10% of the total budget. That’s when the sushi really hits the fan.

You can expect the same kind of vicious math to strike across the entire spectrum of heavily leveraged borrowers going forward, including you and me.

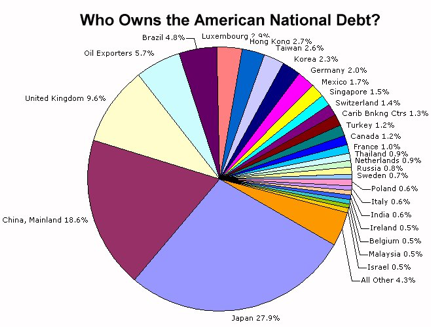

We are also witnessing the withdrawal of the Chinese as major Treasury bond buyers, who along with other sovereign buyers historically took as much as 50% of every issue. Declare a trade war on your largest lender and it plays hell with your cash flow.

Don’t expect them back until the dollar starts to appreciate again, unlikely in the face of ballooning federal deficits.

Rising supply against fewer buyers sounds like a recipe for eventually much higher interest rates to me.

Keep in mind that this is only a decade-long view forward. The next big move in interest rates will be down as we slide into the next recession, possibly all the way to zero. As with everything else in life, timing is everything.

So, like I said, things are about to get a whole lot better for the bond-shorting crowd. Just watch this space for the next Trade Alert regarding when to get back in for the umpteenth time.