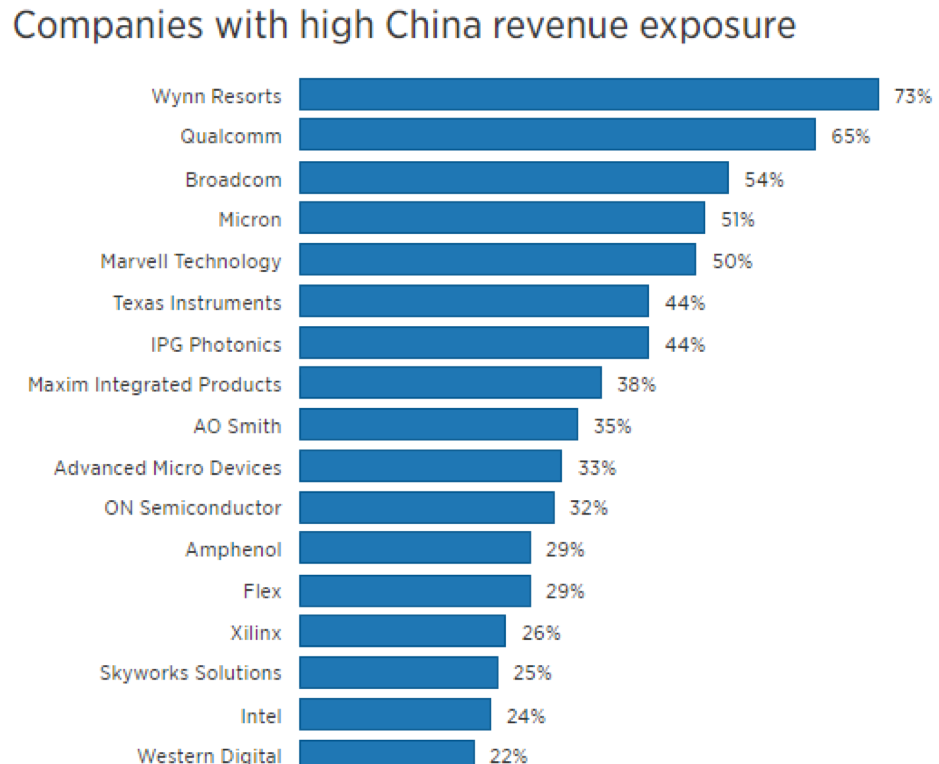

The overwhelming victors of the G20 were the semiconductor companies who have been lumped into the middle of the U.S. and China trade war.

Nothing substantial was agreed at the Osaka event except a small wrinkle allowing American companies to sell certain chips to Huawei on a limited basis for the time being.

As expected, these few words set off an avalanche of risk on sentiment in the broader market along with allowing chip companies to get rid of built-up inventory as the red sea parted.

Tech companies that apply chip stocks to products involved with value added China sales were also rewarded handsomely.

Apple (AAPL) rose almost 4% on this news and many investors believe the market cannot sustain this rally unless Apple isn’t taken along for the ride.

Stepping back and looking at the bigger picture is needed to digest this one-off event.

On one hand, Huawei sales comprise a massive portion of sales, even up to 50% in Nvidia’s case, but on the other hand, it is the heart and soul of China Inc. hellbent on developing One Belt One Road (OBOR) which is its political and economic vehicle to dominate foreign technology using Huawei, infrastructure markets, and foreign sales of its manufactured products.

Ironically enough, Huawei was created because of exactly that – national security.

China anointed it part of the national security apparatus critical to the health and economy of the Chinese communist party and showered it with generous loans starting from the 1980s.

China still needs about 10 years to figure out how to make better chips than the Americans and if this happens, American chip sales will dry up like a puddle in the Saharan desert.

Considering the background of this complicated issue, American chip companies risk being nationalized because they are following the Chinese communist route of applying the national security tag on this vital sector.

Huawei is effectively dumping products on other markets because private companies cannot compete on any price points against entire states.

This was how Huawei scored their first major tech infrastructure contract in Sweden in 2009 even though Sweden has Ericsson in their backyard.

We were all naïve then, to say the least.

Huawei can afford to take the long view with an Amazon-like market share grab strategy because of possessing the largest population in the world, the biggest market, and backed by the state.

Even more tactically critical is this new development crushes the effectiveness of passive investing.

Before the trade war commenced, the low-hanging fruit were the FANGs.

Buying Google, Amazon, Apple, Netflix, and Facebook were great trades until they weren’t.

Things are different now.

Riding on the coattails of an economic recovery from the 2008 housing crisis, this group of companies could do no wrong with our own economy flooded with cheap money from the Fed.

Well, not anymore.

We are entering into a phase where active investors have tremendous opportunities to exploit market inefficiencies.

Get this correct and the world is your oyster.

Get this wrong, like celebrity investors such as John Paulson, who called the 2008 housing crisis, then your hedge fund will convert to a family office and squeeze out the extra profit through safe fixed income bets.

This is another way to say being put out to pasture in the financial world.

My point being, big cap tech isn’t going up in a straight line anymore.

Investors will need to be more tactically cautious shifting between names that are bullish in the period of time they can be bullish while escaping dreadful selloffs that are pertinent in this stage of the late cycle.

In short, as the trade winds blow each way, strategies must pivot on a dime.

Geopolitical events prompted market participants to buy semis on the dips until something materially changes.

This is the trade today but might be gone with one Tweet.

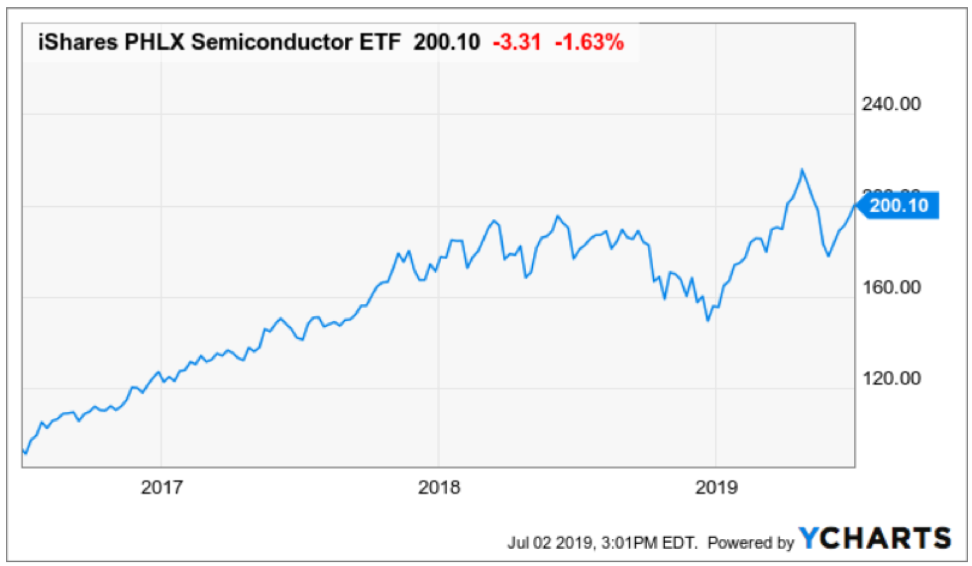

If you want to reduce your beta, then buy the semiconductor chip iShares PHLX Semiconductor ETF (SOXX).

I will double down in saying that no American chip company will ever commit one more incremental cent of capital in mainland China.

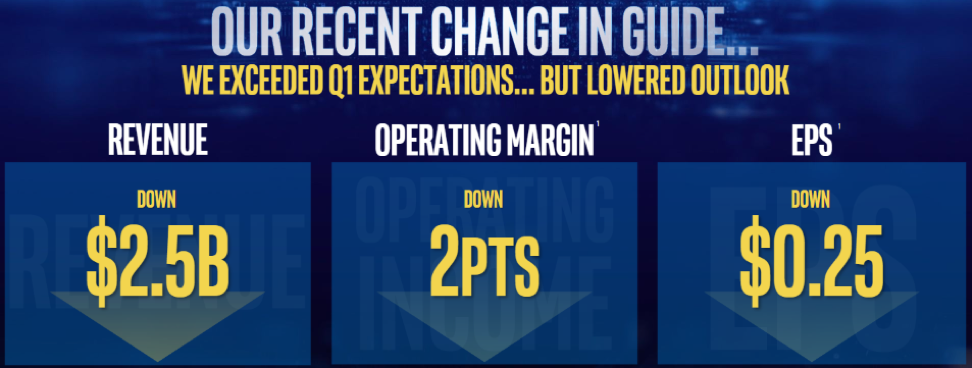

That ship has sailed, and the transition will whipsaw markets because of the uncertainty in earnings.

The rerouting of capital expenditure to lesser-known Asian countries will deliver control of business models back to the corporation’s management and that is how free market capitalism likes it.

Furthermore, the lifting of the ban does not include all components, and this could be a maneuver to deliver more face-saving window-dressing for Chairman Xi.

In reality, there is still an effective ban because technically all chip components could be regarded as connected to the national security interests of the U.S.

Bullish traders are chomping at the bit to see how these narrow exemptions on non-sensitive technologies will lead to a greater rapprochement that could include the removal of all new tariffs imposed since last summer.

The risk that more tariffs are levied is also high as well.

I put the odds of removing tariffs at 30% and I wouldn’t be surprised if the administration doubles down on China to claim a foreign policy victory leading up to the 2020 election which could be the catalyst to more tariffs.

It’s difficult to decode if U.S. President Trump’s statements carry any real weight in real time.

The bottom line is the American government now controls the mechanism to when, how, and the volume of chip sales to Huawei and that is a dangerous game for investors to play if you plan on owning chip stocks that sell to Huawei.

Artificial intelligence or 5G applications chips are the most waterlogged and aren’t and will never be on the table for export.

This means that a variety of companies pulled into the dragnet zone are Intel (INTC), Nvidia (NVDA), and Analog Devices (ADI) as companies that will be deemed vital to national security.

These companies all performed admirably in the market following the news, but that could be short lived.

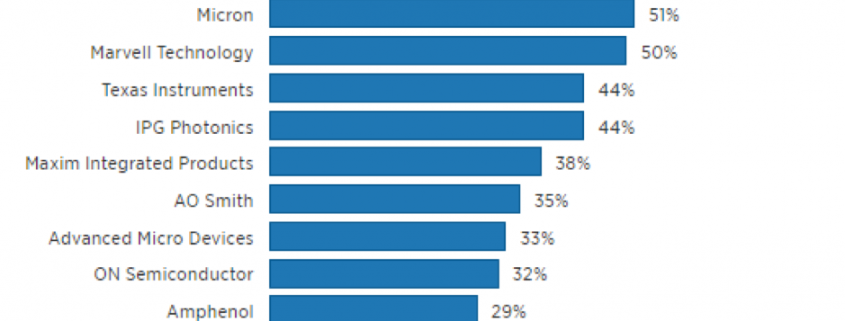

Other major logjams include Broadcom’s future revenue which is in jeopardy because of a heavy reliance on Huawei as a dominant customer for its networking and storage products.

Rounding out the chip sector, other names with short-term bullish price action are Qualcomm (QCOM) up 2.3%, Texas Instruments (TXN) up 2.6%, and Advanced Micro Devices (AMD) up 3.9%.

(AMD) is a stock I told attendees at the Mad Hedge Lake Tahoe conference to buy at $18 and is now above $31.

Xilinix (XLNX) is another integral 5G company in the mix that has their fortunes tied to this Huawei mess.

Investors must take advantage of this short-term détente with a risk on, buy the dip trade in the semi space and be ready to rip the cord on the first scent of blood.

That is the market we have right now.

If you can’t handle this environment when there is blood in the streets, then stay on the sidelines until there is another market sweet spot.