Now you see it, now you don?t.

That was the question observers of international monetary flows were asking after last week?s data release from the Federal Reserve. These showed that some $104.5 billion in Treasury securities held in custody accounts were withdrawn.

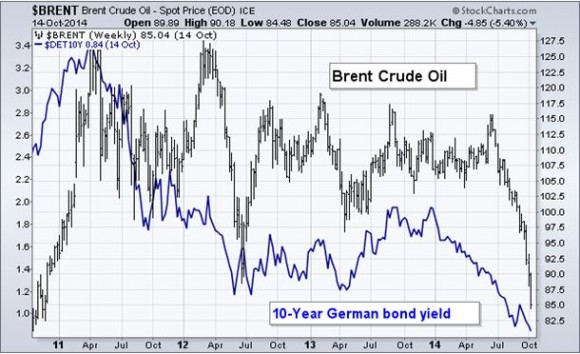

It doesn?t mean that these bonds were sold. You certainly would have noticed this in the Treasury market, where a liquidation of this size could have moved prices down and yields up as much as 20 basis points. In fact prices went up and yields down during the week in question.

They were simply transferred from one custodian to another. Why this matters in an age when securities are only issued in electronic, not physical form, is beyond my pay grade.

Of course, all fingers pointed to Russia, who was thought to have made the move to avoid coming economic sanctions in the wake of their annexation of Crimea. The sanctions did come, but were primarily imposed on the oligarchs, not on governmental institutions, as a way of singling out Vladimir Putin?s political and financial backers.

Do the oligarchs own this much US government paper? Probably.

The Russians have valid concerns. The United States has seized more sovereign assets than any other country in history.

It did so against Japan and Italy, and Germany twice during WWI and WWII. Few know this, but the Bayer Company of aspirin fame in the US, is separate from Bayer in Germany, the former seized by the US and sold off as an alien asset during the Second World War. Today, the US is sitting on $100 billion worth of Iranian assets.

In the global scheme of things, this is not that big of a deal. Russia ranks only 11th among foreign holders of Treasury debt, with $139 billion, far behind China ($1.26 trillion) and Japan ($1.18 trillion). The great irony in these numbers is that they show that if the US wants to protect anyone from a Chinese attack, they have to borrow money from China to do it.

This could be part of a broader trend of cash rich countries withdrawing their savings from the US. Much was made of this when Germany asked for the return of the bulk of its gold bullion holdings held by the Federal Reserve Bank of New York at 33 Liberty Street, NY, NY last year (former Treasury Secretary Tim Geithner?s old hang out).

I?ve been in that vault. There, behind steel bars, are dozens of pallets piled high with 100 ounce gold bars, each labeled with the country of ownership. When gold reserves are transferred from country to country, they are simply carried (with white gloves to avoid friction) from one pallet to the next.

This has been the fuel for endless conspiracy theories on the internet, which over the years anticipated a dollar crash, a default of the US government, a takeover by the Trilateral Commission, or a complete collapse of the global financial system.

The reality is a little more mundane. The Fed took deposit of European gold reserves after WWII in case The Russian Army overran Western Europe. In the end, they didn?t. We had nukes, and they had none.

However, given the machinations of Putin in Crimea in recent weeks, the Germans might think about sending their gold bullion back to the New York Fed, post haste.